How to download income tax challan 2023-24|Reprint Tax Challan Receipt| Income Tax Challan download.

Income Tax payment can be done online using E-pay tax facility of income tax portal, but sometimes payer forgot to download challan after payment or unable to fetch the challan details after payment, so this video is for the help to find lost challan receipt, or you can say missing challan details after payment of income tax by any person.

How to download Income tax challan | How to get missing challan details | Income Tax payment 2023

how to download income tax challan 2023-24

Reprint Tax Challan Receipt

how to download income tax challan receipt

how to download income tax challan from sbi

how to download income tax challan from axis

how to download income tax challan from hdfc

how to download income tax challan from icici

how to download bsr code and challan number .

how to download income tax return receipt

how to pay income tax online

how to pay income tax income tax paid challan download

how to find out bsr code and challan number

/ @ashishkumar-di9mp

Please Subscribe to the channel now for high-quality videos focused on different areas of :-

1.GST

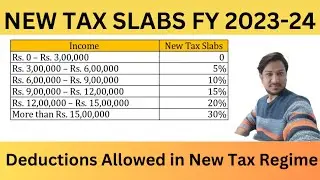

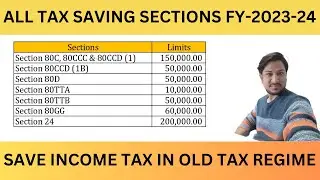

2. INCOME TAX

3. ACCOUNTING

4. TDS RETURNS

5. GST RETURN

GST Course #1 What is GSTR-1, GSTR-2, GSTR-3B,ITC In detail | GST basic to advance sikhe

PART-1 LINK:- • Free GST Complete Course in Hindi|Wha...

Tally Features in GST| GST basic to advance course

PART-2 LINK:- • GST basic to advance course Part-2|| ...

Tally Prime- Purchase Entry With GST in Tally| Purchase Bill Entry Kaise kare with Multiple GST rate

PART-3 LINK • Tally Prime- Purchase Entry With GST ...

Create sales voucher with multiple Tax rate

PART-4 LINK:- • Tally Prime- Purchase Entry With GST ...

Watch video How to download income tax challan 2023-24|Reprint Tax Challan Receipt| Income Tax Challan download. online, duration hours minute second in high quality that is uploaded to the channel Accounting & Gst Insights 20 November 2023. Share the link to the video on social media so that your subscribers and friends will also watch this video. This video clip has been viewed 115 times and liked it 4 visitors.

![Кишлак feat. семьсот семь - Без ответа [Клип]](https://images.reviewsvideo.ru/videos/uNie1bbzvqg)