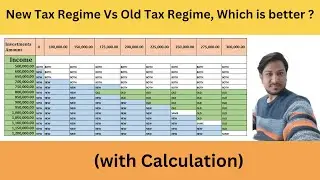

New Tax Regime vs Old Tax Regime|Income Tax Calculation between 5 Lakh to 12 Lakh.(With Calculation)

New Tax Regime vs Old Tax Regime FY-2023- 2024|Which is better for For Salaried Employees? (With Calculation)

Income Tax Calculation between 5 Lakh to 12 Lakh.

New Tax Regime vs Old Tax Regime, Which is better base on your income and investment.

In this video we will see New Tax Regime vs Old Tax Regime which is better (Old Tax Regime vs New Tax Regime) with income tax slab rates FY 2023-24. We will see the income tax calculation process with the help income tax calculator with examples of base your income and investment.

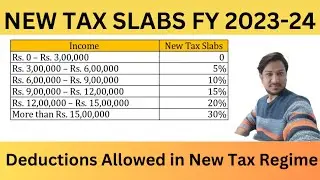

New Tax Regime Slab Rates for FY 2023-24 are as follows:

Rs. 0 to Rs. 3 Lakh Income = 0% Tax

Rs. 3 Lakh to Rs. 6 Lakh Income = 5% Tax

Rs. 6 Lakh to Rs. 9 Lakh Income = 10% Tax

Rs. 9 Lakh to Rs. 12 Lakh Income = 15% Tax

Rs. 12 Lakh to Rs. 15 Lakh Income = 20%

Tax Rs. 15 Lakh and above Income = 30% Tax

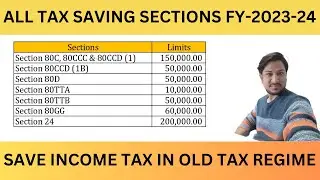

Old Tax Regime Slab Rates for FY 2023-24 are as follows:

Rs. 0 to Rs. 2.5 Lakh Income = 0% Tax

Rs. 2.5 Lakh to Rs. 5 Lakh Income = 5% Tax

Rs. 5 Lakh to Rs. 10 Lakh Income = 20% Tax

Rs. 10 Lakh and above Income = 30% Tax

New vs Old Tax Regime Intro

-Income Tax Slab Rates FY 2023-24 & AY-2024-25

-Deductions Allowed to Save Income Tax

-Old Tax Regime vs New Tax Regime Calculation

-Income Tax on Rs. 12 Lakh Income with new regime & with old regime

-Summary of Old Tax Regime & New Tax Regime Calculations

-Using Tax Rebate u/s 87A for ZERO Tax

-New Tax Regime vs Old Tax Regime Conclusion

Tax rebate 87A limit for taxable income in old tax regime is Rs. 5 lakh and with new tax regime the limit is Rs. 7 lakh up to which no income tax need to be paid.

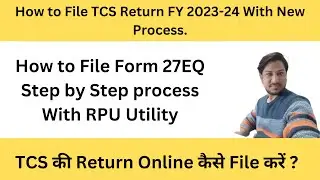

Deductions in New Tax Regime AY 2024-25| New tax regime 2024|New tax regime vs Old tax regime 2024|

deductions in new tax regime 24-25

new tax regime 2024

new tax regime vs old tax regime 2024

new tax regime deductions ay 24-25

old vs new tax regime 2024

standard deduction in new tax regime 24-25

new vs old tax regime ay 2024-25

new tax regime deductions in hindi 24-25

new tax regime 2024

old tax regime vs new tax regime

new tax regime slab rates ay 24-25

new tax regime slab rates fy 23-24

new vs old tax regime

new tax regime vs old tax regime

new tax regime

new tax regime vs old tax regime which is better

new tax regime vs old tax regime difference

old tax regime

which is better new or old tax regime

which is better old or new tax regime

income tax calculation how to calculate income tax

new income tax calculation in excel

income tax calculation 2023-24

income tax slab 2023-24

new income tax slab 2023-24

income tax slab 2023-24 old and new regime

Download excel sheet Link: -

https://docs.google.com/spreadsheets/...

Income tax slabs FY 2023-24 & AY 2024-25 calculation with new tax regime and old tax regime.

• Income tax slabs FY 2023-24 & AY 2024...

New Tax Slabs FY 2023-24 & AY-2024-25|Deductions Allowed in New Tax Regime| New Tax Regime Exemption.

• Deductions Allowed in New Tax Regime|...

If you want learn about What is GST, How to file GSTR-1.

Please click on given link below:-

GST Course #1 What is GSTR-1, GSTR-2, GSTR-3B,ITC In detail | GST basic to advance sikhe

PART-1 LINK:- • Free GST Complete Course in Hindi|Wha...

Tally Features in GST| GST basic to advance course

PART-2 LINK:- • GST basic to advance course Part-2|| ...

Create sales voucher with multiple Tax rate

PART-3 LINK:- • Tally Prime- Purchase Entry With GST ...

Create Sales Invoice with Multiple GST rate

PART-4 LINK:- • Part-4, Create Sales Invoice with Mul...

GSTR 1 Return Filing online-2023

PART-5 LINK • How to File GSTR 1| GSTR 1 Return Fil...

Watch video New Tax Regime vs Old Tax Regime|Income Tax Calculation between 5 Lakh to 12 Lakh.(With Calculation) online, duration hours minute second in high quality that is uploaded to the channel Accounting & Gst Insights 28 January 2024. Share the link to the video on social media so that your subscribers and friends will also watch this video. This video clip has been viewed 1,040 times and liked it 8 visitors.