Canada's Economic Shift: Falling GDP, Immigration, and Interest Rates – What It Means for Housing

In a climate of economic turbulence, Canada’s economy is showing signs of a downturn that could significantly affect Vancouver’s real estate market. The Bank of Canada recently reduced its interest rate by 50 basis points, following weaker-than-expected inflation and a rise in business insolvencies.

While these rate cuts may offer mortgage relief, they’re also weakening the Canadian dollar, which has hit a 20-year low against the U.S. dollar, potentially increasing imported inflation as time goes on. Meanwhile, Canadian GDP has remained stagnant, with annual growth forecasts now below 1%, well below the anticipated 2.8%. This slower growth could prompt further rate cuts as the Bank seeks to stimulate the economy.

Employment trends are also concerning, especially among young men, with unemployment for this demographic rising sharply, indicating possible downward pressure on inflation. We touch on declining sales in manufacturing and a troubling inventory-to-sales ratio that's been further emphasized by the challenges facing Canada’s economy.

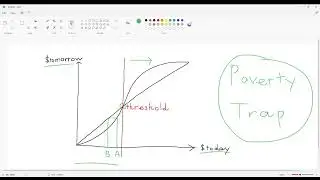

Housing offers a mixed picture: as mortgage payments drop and rates fall, consumer confidence is on the move up. Sales volumes are expected to increase next year by 10%-20%, but the government’s recent immigration cuts could also reduce that demand, especially for rentals. The new targets project significant reductions in Canada’s temporary resident population, potentially leading to Canada’s first-ever years of negative population growth, impacting GDP, tax revenues, and the housing sector's stability. This would be a first for Canada after non-permanent residents hit an all-time high of 3 million people.

The Vancouver housing market stands to be directly affected. Dropping interest rates may ease some home-buying pressures, but declining immigration and job losses in construction and housing services could lead to a long-term housing shortage and potential tax increases as governments try to offset reduced revenues. For buyers and renters alike, this evolving economic landscape could spell both opportunities and challenges, making it a crucial topic for those involved in Vancouver real estate.

Also, we are welcoming your questions!! With these complex dynamics at play, what questions do you have about the market or where you find yourself today? Message us directly or post them in the comment section below, and we’ll provide informed insights in next week’s episode!

_________________________________

Connect With Us To Talk Real Estate:

📆 https://calendly.com/thevancouverlife

🏡 Valuable Videos For Buyers & Sellers 🏡

BC's Multiplex Plan: Game-Changer for the Housing Landscape : • BC's Multiplex Plan: Game-Changer for...

Canada's Economic & Real Estate Future with BMO's Chief Economist Doug Porter : • Canada's Economic & Real Estate Futur...

Top 10 Pros and Cons of Living In Vancouver British Columbia : • Top 10 Pros and Cons of Living In Van...

🏡 Visit our website to see active listings and valuable Real Estate information 🏡

→ The Vancouver Life: https://bit.ly/3yN25V7

💥 Follow us on Social Media 💥

→ Instagram: https://bit.ly/3jSkRo1

→ Facebook: https://bit.ly/3g05bxK

→ Twitter: https://bit.ly/3xMGFpZ

The Vancouver Life Real Estate Group are licensed Real Estate Agents at eXp Realty Vancouver

🏆 Top 10% Medallion Club Members 2019 to 2024

🏆 Over $400,000,000 in sales

www.thevancouverlife.com

_________________________________

Watch video Canada's Economic Shift: Falling GDP, Immigration, and Interest Rates – What It Means for Housing online, duration hours minute second in high quality that is uploaded to the channel Living In Vancouver - Vancouver Life Real Estate 01 January 1970. Share the link to the video on social media so that your subscribers and friends will also watch this video. This video clip has been viewed 5,414 times and liked it 79 visitors.